Credit Card Processing FAQ

This document is complied to assist our clients in navigating the payment processing selection and setup.

The frequently asked questions and answers in this credit card processing document refers to the process outside of TRUX. You can find this document and more information on the nsoftware website via https://www.nsoftware.com/in/faq/creditcard.aspx.

Q: What happens during a typical Internet Credit Card transaction?

A: Typically, a transaction will take place in two phases, a charge and a settlement. In the first phase a charge is made and money for the transaction is set aside from the cardholders account. In the second phase, that money is transferred from the cardholder to the merchant. In general, the first transaction takes place as soon as the card is submitted, allowing the merchant to quickly secure the funds for the transaction. The second phase takes place later, and is usually done in batches at the end of the business day. Settlements are done in batches because some processors limit the number of settlements that you can do during a certain period, and because it's easier and more economical to void a transaction before funds are transferred, than to credit a cardholder account after the fact. If you have ever checked your bank statement to find that there is a separate total for what you have and what is available, this means that a charge has been placed on your account that has not been settled yet.

- A customer provides their credit card information to a merchant. Credit card information can be submitted in a number of ways, i.e. their card is swiped though a terminal, they present their card information over the phone, or they type their card information to a website. Depending on how the customer submits their information to the merchant, they can send additional information to the merchant to indicate the type of transaction (i.e., if their card was present, additional data will be read from the card and submitted to the merchant to prove that).

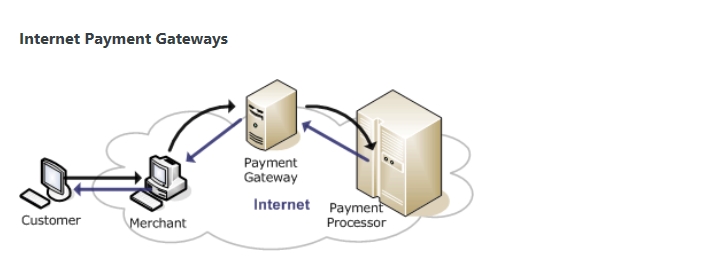

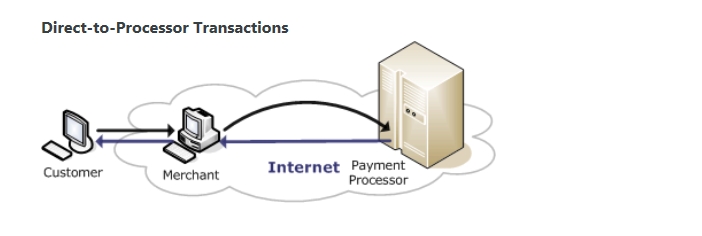

- A merchant submits the credit card information to either a processor for approval or to a payment gateway. If the merchant submits their information to a gateway, then the gateway will in turn submit the cardholders information to a processor for approval.

- The processor runs a check on the card, and will respond with an approval or rejection for the transaction to the merchant or the gateway (who will pass that information back to the merchant). The amount of funds requested will be held on the cardholders account, but will not be transferred out yet.

- The merchant notifies the customer of the success or failure of the transaction. If the transaction is successful, then the merchant will ship products/provide services to the customer.

- At a later time, usually at the end of the day or week, the merchant (or if the merchant is using a gateway, then the merchant’s gateway) will settle the transactions it has performed that day. By communicating again with the processor, the funds that were charged earlier are then transferred for the cardholders accounts to the merchants account.

Q: What are some of the means that a customer can provide their credit card information, and what is the difference?

A: Most credit card transactions can be broken down into two types : e-commerce transactions and card present transactions. The fees associated with credit card transactions are dependent on the type of transaction, so it is important to note the differences between the two.

An e-commerce transaction or a mail-order-telephone-order (MOTO) transaction is a transaction where the credit card is not present. These transactions are usually either online transactions or phone transactions where the credit card number, expiration date and billing information are taken from the customer. Because transactions where the credit card is not physically present are more prone to fraud or theft, the fees associated with these types of transactions are typically higher than then when the credit card is present for verification to allow for the costs associated with charge-back fraud.

A card present transaction is one where the credit card being charged is physically present and swiped through a terminal. These are referred to as POS (Point Of Sale) transactions. The credit card number, expiration date, and any additional data are read from the magnetic stripe on the back of the credit card. Because of the added security provided by a card present transaction, the fees associated with each transaction are typically lower.

Q: What are the differences between the different credit card processing suites (examples: E-Payment, TSYS, & Paymentech)?

A: The E-Payment Integrator is used to submit credit card or eCheck (ACH) transactions to Internet payment gateways.

Using E-Payment Integrator for processing Credit Card & eCheck transactions:

- TSYS Integrator submits credit card transactions directly through TSYS Processing Services ( ) while Paymentech Integrator uses Paymentech () as it's credit card processing engine.

Q: How do I settle transactions with the E-Payment Integrator?

A: Since E-Payment Integrator communicates with a payment gateway it is not necessary for the component to handle transaction settlement. Instead, the gateway manages the settlement aspect of the transaction on its own. The merchant usually has access to a web-interface where he can manage and log these settled transactions. Instructions for settling transactions are given when signing up with a particular gateway. Normally transactions are settled at the end of a business day by the gateway itself. However, setting the Transaction Type to 'Authorize' instead of 'Sale' will change this behavior for most gateways. The 'Authorize' transaction type will block funds, but those funds will not be transferred until the merchant settles the transaction manually.

Q: What is a payment gateway?

A: A gateway is a value added service provider that will, in exchange for fee (usually a percentage of your sales, and a number of associated fees), accept and process credit card transactions from you. Payment Gateways generally provide additional services beyond payment processing such as transaction logging, automatic settlement, and reporting as well as additional security and fraud prevention.

Q: What is a payment processor?

A: A payment processor is a service company that performs charges and settlements for credit card transactions. Every credit card transaction eventually goes through a payment processor.

Q: What is a merchant account?

A: A merchant account is simply a bank account that is setup for a merchant. The big difference between a merchant account and a regular bank account is that a merchant account provides support for one or more processors to deposit funds from credit card transactions made through them.

Q: What do I have to do to go through a payment processor?

A: You simply need to make sure that you have a merchant account that is compatible with that processor. You can check with the bank that issues your merchant account about what processors are supported, but generally you are going to find that most merchant accounts support the TSYS processor.